missouri gas tax refund

It will rise to 22 cents per gallon on July. With the passage of Senate Bill 262 the Missouri Department of Revenue made changes to some of the forms used when requesting a refund of taxes paid on Missouri motor fuel used for non-highway purposes.

How To Get Your Gas Tax Refund By Using Forms From The Missouri Department Of Revenue

People who buy gas for vehicles weighing less than 26000 pounds and drive on highways are.

/cloudfront-us-east-1.images.arcpublishing.com/gray/UHLVITR6PJFVXJ3RIWIG52W2XY.jpg)

. Refund claims must be submitted on or after July 1st but no later than September 30th following the fiscal year in which the tax was paid. Missourians will be eligible to receive their first refund on July 1 2022. Mike Parson in July raises the price Missouri drivers pay on gasoline by an additional 25 cents per gallon every year until 2025 for.

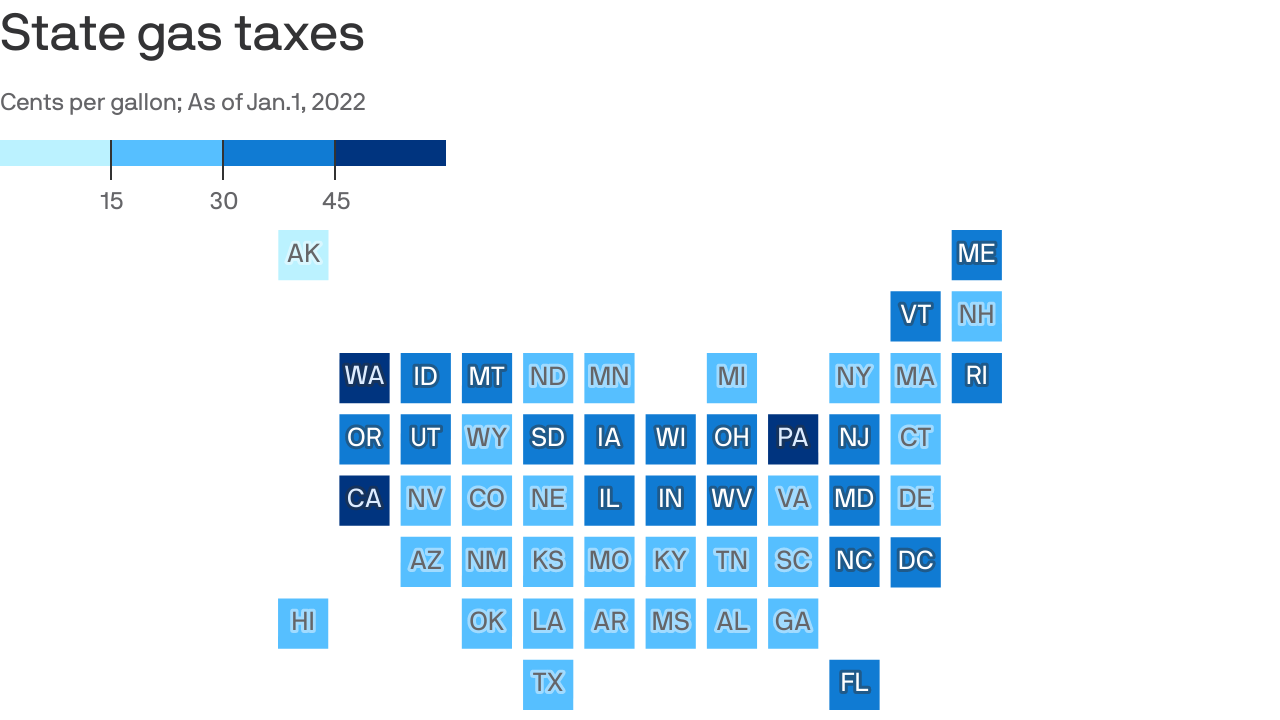

Missouris gas tax currently sits at 195 cents per gallon among the lowest rates in the country. News Sports Entertainment Lifestyle Opinion USA TODAY Obituaries E. The copy of the new form called a Form 4923-H was available online Tuesday.

Under SB 262 you may request a refund of the Missouri motor fuel tax increase paid each year. Vehicle weighs less than 26000 pounds. Refund claims must be postmarked on or after July 1 but no later than September 30 following the fiscal year for which the refund.

Please refer to the Motor Fuel Tax Non-Highway Form Updates for more information. The bill also offers provisions that allow Missourians to request a refund once a year for refunds on the gas tax in the following amounts. State tax officials said in April they expected to publish a form for gas tax refunds in May.

Missouri drivers can start submitting refunds to receive the money they spent on a state gas tax just as the tax increases July 1. The tax which was signed into law by Gov. There are about 700 licensees including suppliers distributors transporters and terminal operators.

Use this form to file a refund claim for the Missouri motor fuel tax increase paid beginning October 1 2021 through June 30 2022 for motor fuel used. 1 2021 through June 30 2022. Missouri Department of Revenue has forms online that allows Missourians to apply for a refund on the two-and-a-half cents per gallon gas tax increase.

Missouris motor fuel tax rate will increase by 25 cents per gallon annually on July 1 until it reaches 295 cents in July 2025. Instructions for completing form. The bill passed in 2021 says Missouri drivers who keep their gas receipts between October 1 2021 and June 30 2022 can request a full refund of the additional taxes paid.

Around that time the Missouri DOR announced Missourians might be eligible for refunds of the 25 cents tax increase per gallon paid on gas purchases after Oct. Consumers may apply for a refund of the fuel tax when fuel is used in an exempt manner See the Motor Fuel FAQs for more. The tax is distributed to the Missouri Department of Transportation Missouri cities and Missouri counties for road construction and maintenance.

The Missouri Department of Revenue said as of July 15 theyve received 3175 gas tax refund claims and have some tips for those preparing to file. There is a way to get a refund on the increase. Refunds must be filed on or after July 1 but not later than September 30 following the fiscal year for which the refund is claimed.

Fuel bought on or after Oct. Form 4923 must be accompanied with the applicable Form 4923S Statement of Missouri Fuel Tax Paid for Non-Highway Use. The Missouri Department of Revenue will begin accepting gas tax refund claims July 1 2022 on a form designated as 4923-H the top of which is depicted here.

To get the refund drivers need to fill out a fuel refund claim form and submit it from July 1 2022 through Sept. The Missouri gas tax rises to 195 cents per gallon Friday. 25 cents in 2022.

Gas Tax Refund. The Missouri Department of Revenue now has forms online for residents to apply. To claim the gas stimulus check from Missouri drivers need to provide details from saved gas receipts of the gas they purchased from Oct.

The Missouri gas tax will go up 25 cents every year until the gas tax reaches about 30 cents per gallon. Missouri resident Michael Cromwell said the increase in gas prices is really painful to hear and he encourages Missouri. For on road purposes.

5 cents in 2023. You may be eligible to receive a refund of the 25 cents tax increase you pay on Missouri motor fuel if. Senate Bill 262 allows purchasers of motor fuel for highway use to request a refund of the Missouri motor fuel tax increase paid annually.

On October 1 2021 Missouris motor fuel tax rate increased to 195 cents per gallon. Tax Refund Application must be on file with the Department in order to process this claim and may be submitted at the same time as Form 4923. Use this form to file a refund claim for the Missouri motor fuel tax increases paid beginning October 1 2021 through June 30 2022 for motor fuel used for on road purposes.

How To Claim It. 75 cents in 2024. 1 2021 through June 30 2022.

Vehicle for highway use. Missouris gas tax is currently 195 cents a. Vehicles under 26000 pounds and registered in the state of Missouri are eligible for.

How To Get A Missouri Gas Tax Refund As Gas Prices Increase

Saving Gas Receipts Could Lead To A Refund On Missouri Gas Tax Increase

How To File For Gas Tax Increase Rebate In Missouri Starting July 1

Gas Tax Holiday These 17 States Are Working On Legislation To Ease Costs At The Pump Gobankingrates

State To Begin Accepting Gas Tax Refund Claims

Missouri Drivers Can Claim Gas Tax Refund With Receipts On July 1

Gas Tax Cut Again In Missouri Nextstl

Pennsylvania Bill Would Lower State Gas Tax Axios Philadelphia

Georgia Legislature Votes To Suspend Gas Tax Sends Bill To Governor

Missouri Gas Tax Rebate Opens As Gas Tax Increases St Louis Business Journal

These States Have The Highest And Lowest Gas Taxes As Biden Pushes Tax Holiday

Missouri Drivers Are Now Eligible To Start Filing For Their Gas Tax Refunds With The State Of Missouri Via The Nomogastax App

Missouri Residents Can Get Money Back Through Gas Tax Refund

Gas Prices States With The Highest And Lowest Gas Taxes

/cloudfront-us-east-1.images.arcpublishing.com/gray/UHLVITR6PJFVXJ3RIWIG52W2XY.jpg)

Saving Gas Receipts Could Lead To A Refund On Missouri Gas Tax Increase

How To File For Gas Tax Increase Rebate In Missouri Starting July 1

Black Monday For Small Cap Value Theo Trade Small Caps Black Monday Nasdaq 100

Keep Your Receipts Missourians Can Get Refunds On Gas Tax Increase State News Komu Com